Table Of Content

This will show the equity in your home, along with your principal balance and monthly payment. Certain tax documents, including your two most recent W-2 forms, are also among the documents needed for mortgage preapproval. These documents are another way to verify your income and show how much was taken out for tax purposes. You’ll likely be asked to provide W-2s for the last 2 years from current and past employers within that time frame. Unlike the prequalification process, there are some standard documents you’ll need to submit for a mortgage preapproval. However, other documents may be required depending on the type of loan you want to get, the type of residence you wish to buy and the kind of work you do.

Ultimate Mortgage Preapproval Checklist

The list on the website offers nine ADU design companies that offer pre-approved plans in the city of San Jose. Pre-approved does not mean “doesn’t require approval.” It just means the city has already deemed the plan to be code-compliant. So you still need approval but, it will just be slightly less time-consuming. The Great SoCal House Hunt is a comprehensive guide for first-time home buyers, informed by original reporting and questions from Los Angeles Times readers.

Things to do in San Jose, CA if You’re New to the City

Under PMI/MIP (for mortgage insurance premium)/Fee, two numbers separated by a slash (/) indicate an up-front fee followed by an annual fee (paid monthly). Some types of loans, such as HomeReady (offered by Fannie Mae) and Home Possible (offered by Freddie Mac), are designed for low-income or first-time homebuyers. Department of Veterans Affairs (VA) loans, which typically require no down payment, are for U.S. veterans, service members, and eligible spouses. The chart below shows your monthly principal and interest (PI) payment on a 30-year fixed-interest rate mortgage based on a range of FICO Scores for three common loan amounts. Most lenders require a FICO Score of 620 or higher to approve a conventional loan, and some even require that score for a Federal Housing Administration (FHA) loan. Lenders typically reserve the lowest interest rates for customers with a credit score of 760 or higher.

Find the right lender

It needs to make sure you have a high enough credit score to buy a home. You’ll need to share this information with any lender you’re applying for a preapproval with, so it’s best to have it all organized before you start seeking offers. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

We are not responsible for the third-party’s data privacy practices, services, or overall content on the third-party site. Please review the service provider’s privacy policy for more information about its data privacy practices. It’s important to know how long pre-qualification and pre-approval will be in effect. Different lenders assign different times for which their letters of pre-qualification or pre-approval are good, from 30 to as many as 120 days. When you apply for a mortgage, lenders go to great lengths to ensure that you earn a solid income and have stable employment. That’s why lenders request two years’ worth of W-2 tax forms and contact information for your employer.

Do Preapproval and Prequalification Offers Impact Credit Score?

This means you can borrow much more than you’d be able to with a traditional home equity loan. However, the other ADU pre-approved plan is stick-build and created by a local architect who’s an expert in ADU designs. Since 2019, the year ADUs were legalized in Washington, D.C., architect Illeana Schinder has designed over 20 ADUs.

10 Things Most Homebuyers Get Wrong About Getting a Mortgage Today - Realtor.com News

10 Things Most Homebuyers Get Wrong About Getting a Mortgage Today.

Posted: Mon, 16 Oct 2023 07:00:00 GMT [source]

Keep in mind that the better your financial situation is, the more likely you are to get approved. Applying to multiple lenders helps home buyers compare interest rates and choose the deal with the most favorable terms. Shopping around for a mortgage that best fits your finances can save you a lot of money over the life of the loan. Mortgage preapproval is beneficial for home buyers for a number of reasons. It helps buyers search for homes within their budget, making for a smoother and more efficient house hunt. It also makes an offer more enticing to a seller, and gets a bulk of the mortgage process done early on.

Lenders want to see all of your income and assets and, therefore, will also need to review your investment account statements. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. Tucked into the measure is a provision that gives TikTok’s Beijing-based parent company, ByteDance, nine months to sell it or face a nationwide prohibition in the United States. The administration and a bipartisan group of lawmakers have called the social media site a growing national security concern, which ByteDance denies. “The fact is that it’s going to take some time for us to dig out of the hole that was created by six months of delay,” he said.

Buying Options

Consider requesting preapproval from multiple lenders within a 45-day window to minimize the impact to your credit score. The credit bureaus treat multiple inquiries within this 45-day period as a single inquiry. If you have not opened credit cards or any traditional lines of credit—such as a car loan or student loan—you might have trouble getting a pre-approved mortgage. You can build your credit by opening a starter credit card with a low credit line limit and paying off your bill each month. It could take up to six months for your credit score to reflect your payment activity.

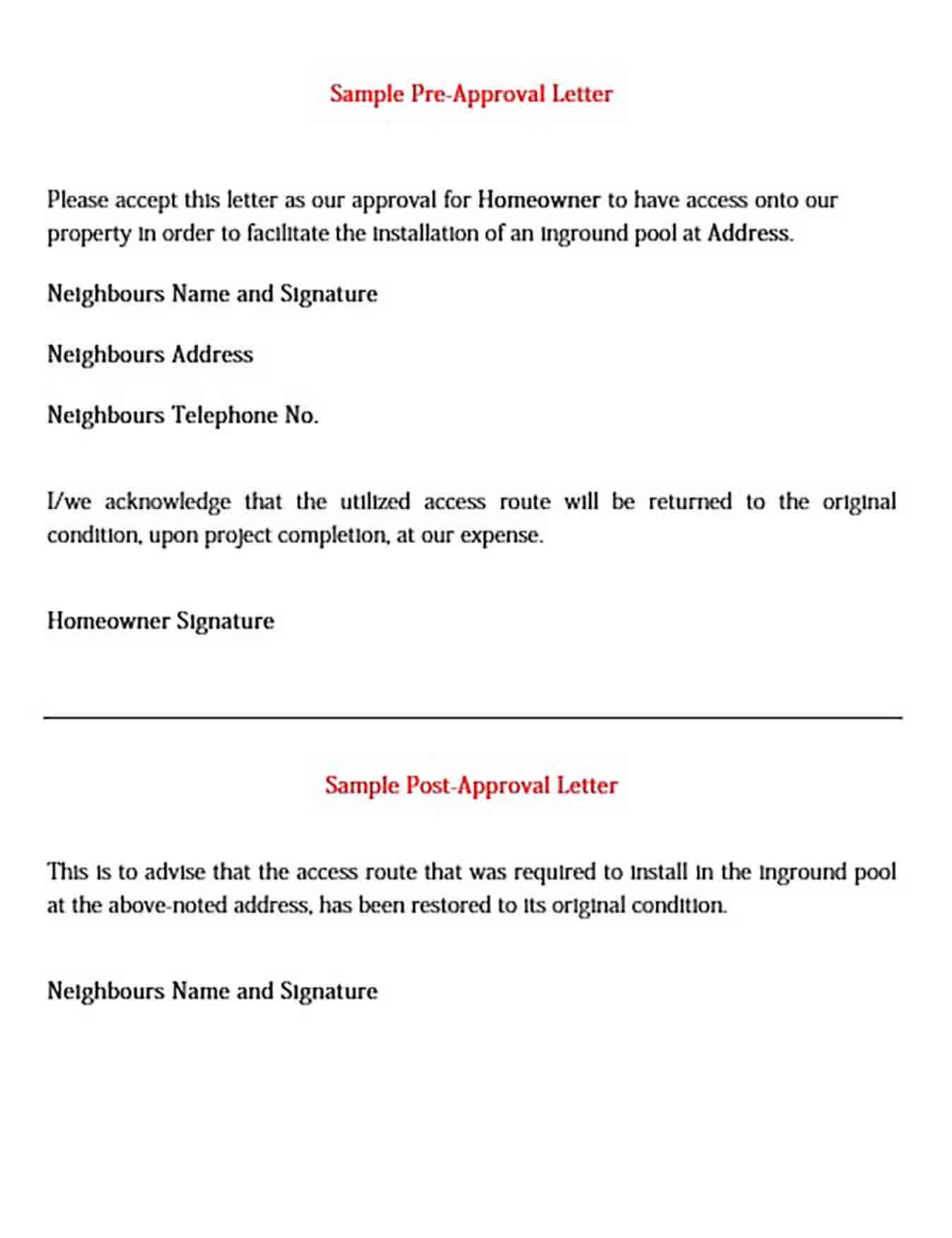

This official document indicates to sellers that you’re a serious buyer and verifies that you have the financial means to make good on an offer to purchase their home. Most sellers expect buyers to have a pre-approval letter and will be more willing to negotiate with those who prove that they can obtain financing. Also, you’ll list all of your bank account information, assets, debts, income, employment history, past addresses, and other critical details for a lender to verify. This is because, above all, a lender wants to ensure you can repay your loan.

Investigate different options to determine who has the lowest rates and fees — and apply in more than one place to compare mortgage offers. Prequalification refers to tools credit card issuers offer that allow individuals to check whether they are prequalified for a credit card. The process is usually initiated online on the card issuer’s website using a form similar to a credit card application. After supplying some basic personal and financial information, the issuer will show you any card offers you’re likely to be approved for based on your situation. When you’ve been preapproved for a credit card, a credit card issuer has targeted you and is likely to approve you. If you’re ready to begin house hunting, your first priority should be getting a mortgage preapproval letter from a lender.

But overall, the time between when you apply for preapproval and when you begin house-hunting depends on your unique situation, how prepared you are and how ready you are to commit to the process. You should consider getting preapproved if you’re ready to begin house hunting. With an active preapproval letter in hand, you’ll significantly increase your chances of having your purchase offer accepted.

No matter what your preference, California’s diverse landscape has something to offer. CU SoCal does not provide and is not responsible for the product, service or overall website content available at these sites. The privacy policies of CU SoCal do not apply to linked websites and you should consult the privacy disclosures on these sites for further information. Buyers often procrastinate on this task, if only because they don’t know where to start when selecting a lender. They also may feel wary about selecting the “wrong” lender, especially if they fear wasting their time or delaying their home buying timeline. You don’t have to stay with the lender that gave you pre-approval, so you can consider applying elsewhere, which is a good idea in any case.

A preapproval provides an initial green light for a home loan based on a review of your finances, and isn’t a guarantee that you’ll receive a final approval. You’ll still need to find a home, negotiate a purchase price, get a home appraisal to confirm the home value supports the sales price and vet the title history to make sure you can safely take ownership of the home. Many sellers want to see a mortgage preapproval letter as part of your home offer, and certainly before they enter into a contract with you. The best time to get a mortgage preapproval is before you start looking for a home. If you don’t and find a home you love, it’ll likely be too late to start the preapproval process if you want a chance to make an offer on the home.

You’ll still need to apply for a mortgage with the lender before you receive any funding. Any lender can quickly preapprove a buyer for the maximum amount that their company permits based on certain variables. A listing agent will have learned over time, though, that these lenders’ customers are more likely to encounter issues before closing. This is one reason why real estate agents are a good source for finding a lender.

A mortgage preapproval is written verification from a mortgage lender that you qualify for the mortgage amount you’ve applied for, based on a review of your credit history, credit scores, income and assets. The “pre” in front of “approval” is short for preliminary, which means the lender still has to validate all of your information to issue a final approval before you close. Once the lender assesses your credit and financial profile, it’ll decide whether you’re preapproved for a mortgage.

No comments:

Post a Comment